Threads and this era of Media Proliferation

Why do new channels matter? How should marketers approach them?

The earliest mentions of “Media Proliferation” that I can find online come in late 2013 and in mid 2014. One is found in an IPA paper entitled “Reaching consumers in an era of media proliferation”, the other is a mention inside a Hubspot-authored presentation on “the state of Inbound Marketing.”

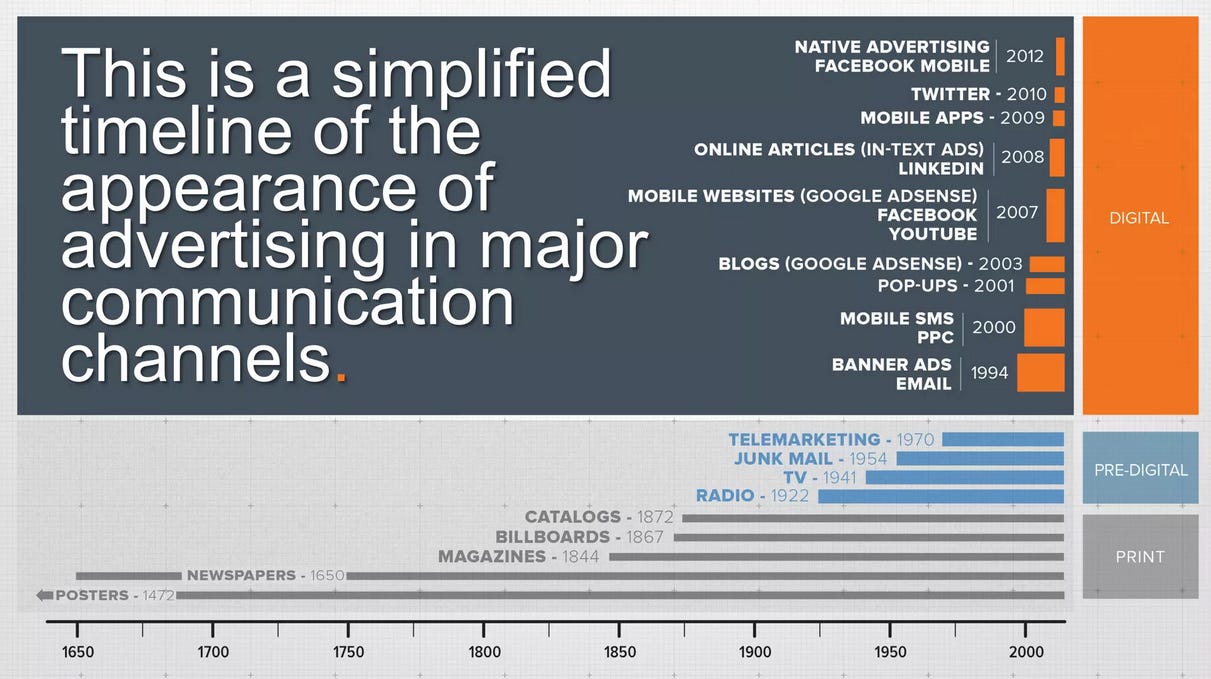

In the latter, we find this graph; at the time, a look at the present and the future which would presumably have scared the old guard of the Print and Pre-Digital era, and now all we see is a relic from the museum of Marketing.

Oh what most CMO’s might give to return to a landscape where this was the full extent of Digital communication channels.

Why? Because their job was much easier! Forget having to form an emergency response to Threads and its 100m strong user base, only to then hear that its retention had nosedived. Most channels, back a decade ago, had not reached any kind of maturity, let alone saturation or meaningful competition for advertising. As Bob Sherwin spoke about in my recent interview with him on

, with a little data know-how and some analytics chops, you’d easily find yourself in the top 1% of marketers in Digital channels.To set the scene: in 2010, Google was introducing remarketing for the first time. Facebook, meanwhile, was a late stage start-up aiming for an IPO, with only 3.1% of all ads were placed there and an offering which, to be generous, felt rudimentary. On this, I loved one story on the recent 20VC podcast from Tripledot’s Co-Founder: when they launched Facebook ads on the mobile app, they simply didn’t work (no conversions, etc).

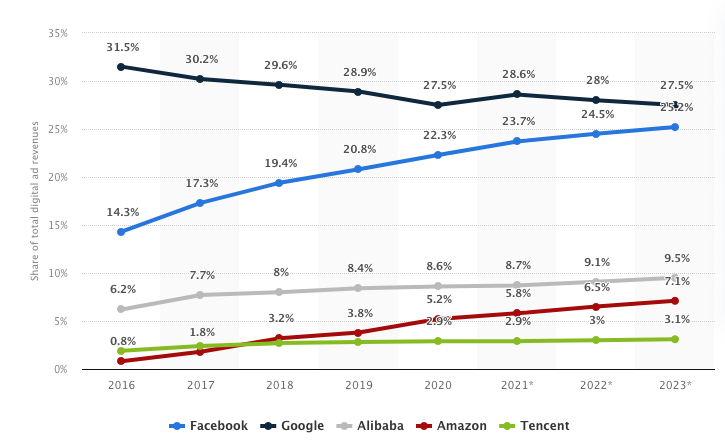

Since then, two core issues have taken shape. First, these now long-standing ad platforms have become a lot more saturated (with ad spend up on Facebook from $1.8b in 2010 to $113b in 2022) and their product suite is a lot more sophisticated - so it’s more expensive and more complicated to win on there. Second, the overall ad revenue share of the top 3 advertising platforms in the Western World (before, Google, Yahoo! And Microsoft and today, Amazon, Facebook and Google) has stayed more or less flat, from ~56% in 2010 to ~59% in 2023.

So for a marketer, this means that to achieve success on the top 3 platforms, you have to devote more and more resources to them, and yet you’ve still got 30% of audiences that are being competed for elsewhere - so spend gets sucked into non-core channels as well, which each have their own intricacies that you have to master.

To redraw just the Digital map as it exists today, as comprehensively as I can for the Western world only, with some of the private data unaccessible or uncertain (e.g. Netflix’s ad product is of course are only functional on its free tier, the subscriber count of which is still in flux), this is what I see in terms of monthly active user base charted against maturity of ad product.

No doubt there are dozens more platforms I may have missed. It remains unclear where (or whether!) Threads will belong on here, once the dust settles.

Time, money and effort is at once more concentrated and more disparate across channels.

To have effective ads, you need to know the grammar of the platform on which you're advertising (why users are there etc) learning these platforms takes time: - we've had 70 years to perfect TV ads - we've only had 3 years of TikTok ads

— Tom Roach

This speaks to a widespread misconception. Namely, taking Media Proliferation to mean only the addition of new channels to the paid media landscape. Of course it is that. But it also means the proliferation of existing channels within themselves; a kind of metastasis where the ad product has spread from an initial or primary site (e.g. Facebook being originally used by “landmark partners including Blockbuster, CBS, Chase, The Coca-Cola Company, Microsoft, Sony Pictures Television and Verizon Wireless” to a secondary site within the host’s body (e.g. Facebook moving to reach the long tail of SMBs that now comprise approximately 3 in every 4 USD spent on Facebook Ads)

So what’s to be done?

At least some of those ad networks in the bottom left hand corner of the graph are going to become important (Beehiiv, Whatnot etc), and the upper right corner (TikTok, LinkedIn etc) are going to move further towards the behemoths (Facebook, Google etc) who themselves are going to keep extending the frontier of MAUs and ad product maturity. Important to note is the speed of potential change here: to take but one example, last year, during Meta’s Q3 earnings call, Zuckerberg mentioned that “click-to-WhatsApp” ads surpassed the annual revenue run rate of $1.5 billion with 80% year-on-year growth.

This outstretched battlefield is exhausting for Marketing leaders; consumers are to be found in a nooks and crannies of an ever-expanding online edifice. But if you want to use paid media to win new hearts and minds, all the while while retaining loyal customers, it’s the new and inescapable reality to be confronted.

Faced with this situation, I find Marketers fall into two camps. There are the ones who are happy to bury their head in the sand of the 2010s - keep ticking along, hide in bureaucracy, and hope other people carry the bag in 3-5 years when their distribution channels and market share have been eroded. Or, and these are the ones I get excited about, there are those, like Bob at Wayfair, who engage purposefully with this new landscape.

For me purposeful engagement involves breaking down your team and budget across three blocks of probability: dead-certs, big bets and new terrain. Rather than leave you with dread about where to take your marketing org from here, I’d like to leave you with a new framework to think about your approach:

As a summer excercise, see if you can plot your channel strategy across these buckets - I’d love to hear what you learnt or how you thought differently as a result.